retroactive capital gains tax history

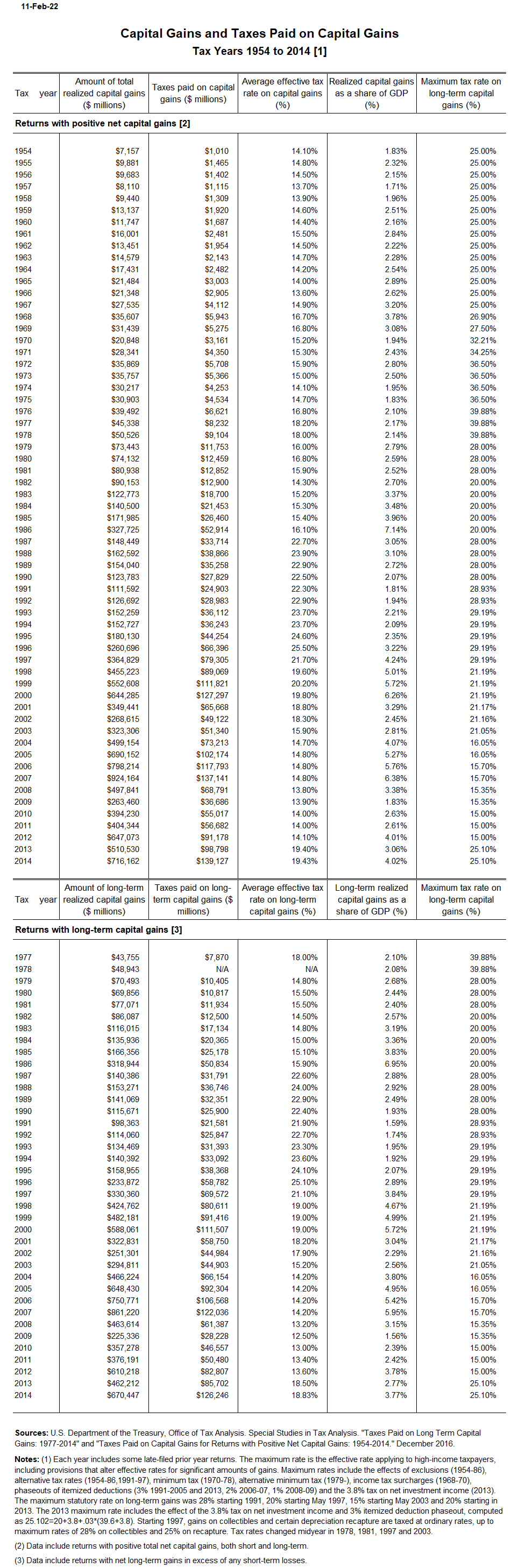

While the most significant recent capital gains rate change provided by the JGTRRA was largely prospective it was still in part retroactive and included a. Eighty-three percent of capital gains were reported by households with income over 200000 and 61 of capital gains were reported by taxpayers with income over 1.

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

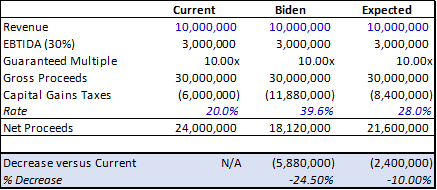

President Joe Biden is formally calling for his proposal for the largest capital gains tax in history to be retroactive.

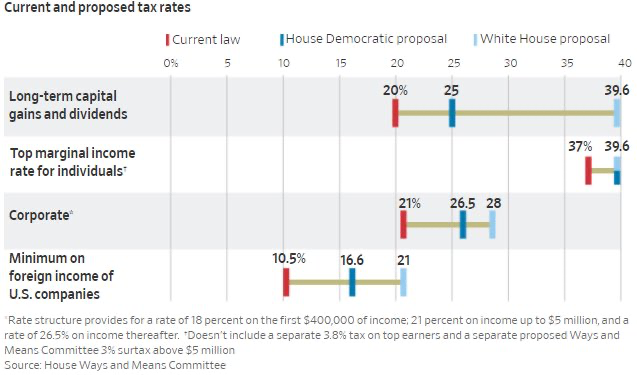

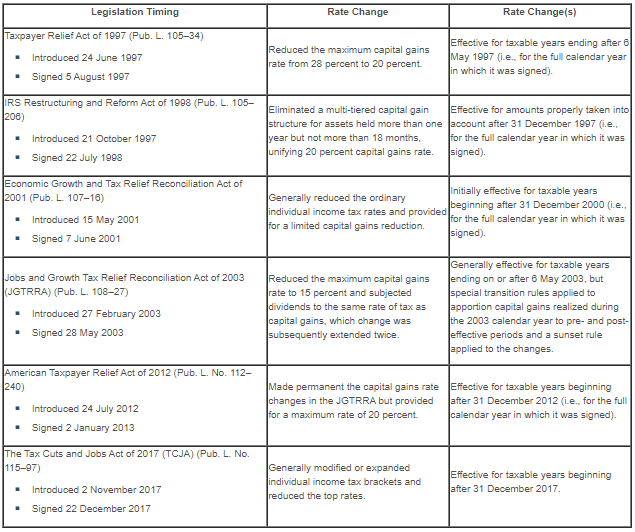

. There is pressure for another wealth tax on individuals making 5 million or more who would see another 3 tax raise. And so the Biden administration proposes to increase the capital-gains. 7 rows Reduced the maximum capital gains rate from 28 percent to 20 percent.

1st Retroactive Capital Gains Increase in US. One of the big surprises included in President Joe Bidens first budget is the retroactive application of the near 100 capital gains tax hike. Indeed we need not look back too far in history to find a prime example of retroactive tax increases.

President joe biden is formally calling for his proposal for the largest capital gains tax in history to be retroactive. The proposed tax increase on capital gains may be applied to taxpayers with annualized realized gains over 1 million. These changes would relate back to April 28 or May 28 2021.

Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year. The 20 tax rate on capital gains can raise as high as. Retroactive tax provisions in 1969 1987 and 1993 withstood constitutional challenges in part because they were designed to create more taxpayer equity and to eliminate.

History Set forth on page 62 of the Green Book tax is the proposal we have all heard about the increase in the capital gains tax. Effective for taxable. Biden plans to increase this to 434 percent for households earning.

Reduced the maximum capital gains rate to 15 percent and subjected dividends to the same rate of tax as capital gains which change was subsequently. This change is significant because it would be the first retroactive capital gains increase in US federal tax. Congress has been adopting retroactive tax increases for a very long time essentially since the 1930s.

Nonetheless large governments are often hard pressed to fund their ambitious spending programs. Retroactive capital gains tax history Monday March 14 2022 Edit In addition the potential for fluctuations in the effective tax rate on capital gains is a factor that is foreseeable. More specifically in August of 1993 Congress passed the Omnibus.

Most states tax capital gains. CNBCs Robert Frank reports. Reduced the maximum capital gains rate to 15 percent and subjected dividends to the same rate of tax as capital gains which change was subsequently extended twice.

The 1913 Revenue Act was the first one with an effective. This resulted in a 60 increase in the capital gains tax. Top earners may pay up to 434 on long-term capital.

Taxes Archives Page 2 Of 3 Cd Wealth Management

Biden Tax Plan Forecast To Bring In 3 6 Trillion In Decade 3

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

Capital Gains Tax In The United States Wikiwand

Historical Capital Gains And Taxes Tax Policy Center

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

Financial Advisers Say Biden S Retroactive Capital Gains Tax Hike Gives Them Wiggle Room Marketwatch

Capital Gains Tax Increases Will Accelerate M A Activity In 2021capital Gains Tax Increases Will Accelerate M A Activity In 2021

Governor Brown S Tax Proposal And The Folly Of California S Income Tax Tax Foundation

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

The Capital Gains Rate Historical Perspectives On Retroactive Changes Lexology

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

President Biden S Budget Adopts One Of California S Most Controversial Ideas

Capital Gains Tax Definition Taxedu Tax Foundation

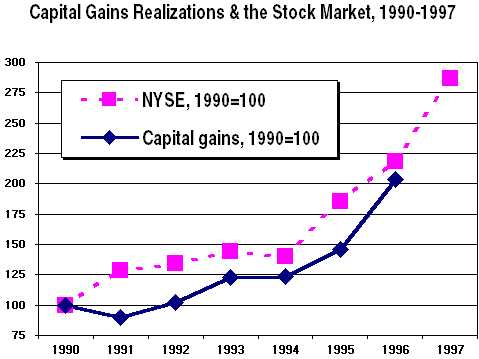

Notes On The Budget Surplus And Capital Gains Citizens For Tax Justice Working For A Fair And Sustainable Tax System

Critics Sound The Alarm Ahead Of Possible Retroactive Capital Gains Tax Hike

Governor Brown S Tax Proposal And The Folly Of California S Income Tax Tax Foundation