chances of retroactive capital gains tax

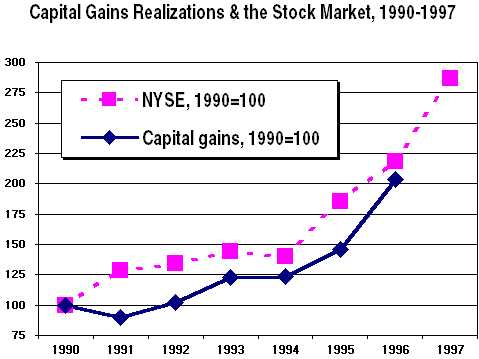

This resulted in a 60 increase in the capital. Perhaps had Congress looked to enact such changes earlier in 2021 the chance to make the capital gains tax changes retroactive to perhaps the start of the year would have been greater.

Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates the.

. And 2 the period of retroactivity is not excessive. The taxes would be retroactive to April. Oh thats a no.

The US Treasury Department on Friday confirmed that the administration is seeking a retroactive effective date on a capital-gains tax rate hike from 20 to 396 for the sliver of households making at least 1 million. What does everyone think of the announcement that Bidens capital gain tax will be retroactive from the time of the announcement. Myers adds he thinks the likelihood of retroactive taxes is greater than 50 percent but notes the Biden administration may settle on a lower rate for capital gains.

In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987. The proposed capital gains rate hike may be retroactive to the date of announcement the. The test upholds retroactive tax application if.

At this point though its looking like the earliest the Biden tax plan will be passed is. 1 the legislation has a rational legislative purpose and is not arbitrary. WSJ News Exclusive Biden Budget Said to Assume Capital-Gains Tax Rate Increase Started in Late April The Wall Street Journal.

Specifically the Greenbook proposes to tax long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million at ordinary income rates with 37. Bidens pre-election proposal advocated almost doubling the top tax rate on capital gains from the current 20 or 238 including the. Id say 50-50 on corporate taxes being retroactive and 25 percent capital gains taxes are retroactive Lucier is slightly more optimistic.

Perhaps had Congress looked to enact such changes earlier in 2021 the chance to make the capital gains tax changes retroactive to perhaps the start of. I dont think make a lot of sense. Ill take that as a no.

Golombek goes on to suggest that should this or a future federal government choose to apply a capital gains tax on the sale of primary residences in the next five years they would be wise to make it prorated based on the length of ownership or value to soften the blow. The Court reasoned that Congress meant to correct a mistake that afforded an unjustified tax loophole and applied the revision retroactively for a modest period. Top earners may pay up to 434 on long-term capital gains including the 38 Obamacare surcharge.

Do you think its going to happen. But retroactive capital gains taxes. Even if the capital gains increase is retroactive they would still save money because the capital gains would be based on a 37 marginal tax rate instead of 396.

For taxpayers with income of over 1 million long-term capital gains will be taxed at ordinary rates. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9 president bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1 million effective for all sales on or after april. Facebook twitter reddit hacker news link.

Biden would also change the tax rules for unrealized capital gains held until death doubling the rate to 40 with an 117 million exemption. This proposal would be effective for gains required to be recognized after the date of announcement Treasury said. The top rate for 2021 is 37 plus the Medicare surtax of 38 plus state tax.

If the capital-gains rate is increased millionaire and billionaire taxpayers would actually face a 434 tax on capital asset sales when factoring in a 38 tax linked to the Affordable Care Act. They have until Oct. 15 to do so.

Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a retroactive basis.

The Build Back Better Tax Alarmists Who Cried Wolf Wealth Management

Build Back Better Stall Could Complicate Tax Planning Investmentnews

Charitable Givers Dodge Draconian Parts Of The Biden Tax Plan So Far Kiplinger

![]()

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

How Will A Capital Gains Tax Hike Affect Red Hot Ria M A Market Investmentnews

If The Democratic Tax Bill Passes Will It Be Retroactive To January 1 2021 Dysart Taylor

The Capital Gains Tax Rate Talked About A Lot But No Change Yet Welch Llp

The Build Back Better Tax Alarmists Who Cried Wolf Wealth Management

Proposed Tax Changes And Planning Opportunities Mission Wealth

Notes On The Budget Surplus And Capital Gains Citizens For Tax Justice Working For A Fair And Sustainable Tax System

Crypto Tax Compliance Remains Minefield As Irs Leaves Key Questions Unresolved

Capital Gains Tax Rate Chasm Separates Trump Biden Wsj

The Capital Gains Tax Rate Talked About A Lot But No Change Yet Welch Llp

12 Tax Angles For Investors What Will Survive The Democratic Congress

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Eye On The Estate Tax Nottingham Advisors

What If Biden S Capital Gains Tax Is Retroactive Morningstar